Germany: Online casino tax would advantage land-based operators in breach of EU state aid rules

04.05.2021

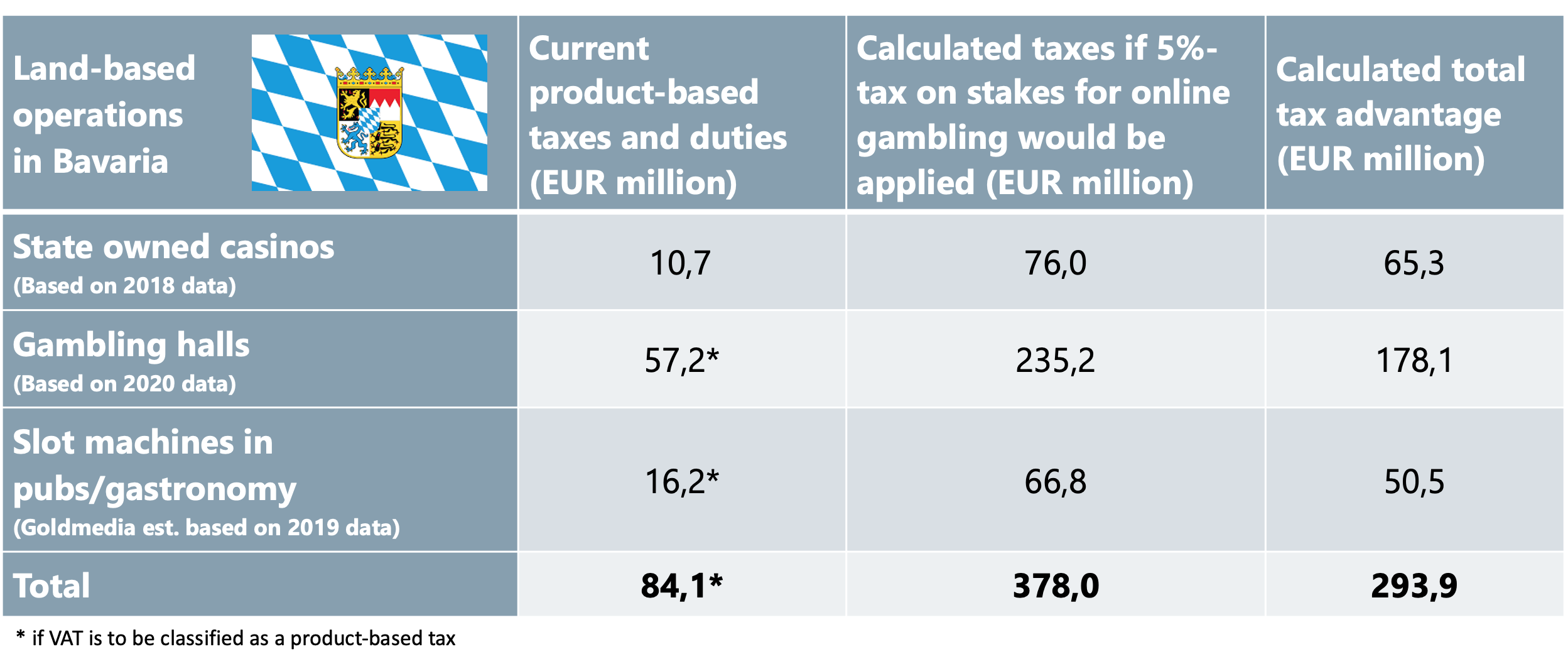

A proposal by Germany’s Bundesrat to tax online poker and slots stakes at punitive rates would lead to more German players using unlicensed websites and offer a substantial and unfair tax advantage to land-based operators, as high as €290 million each year in Bavaria alone.

Brussels, 04 May 2021 – The European Gaming and Betting Association (EGBA) has today warned that a proposal by the German Bundesrat to introduce a 5.3% tax on online poker and slots stakes would undermine the key objective of the country’s new online gambling regulations to direct online poker and slots customers into a regulated market and would be in breach of EU state aid rules.

The effect of the tax measure would be twofold. Firstly, it would impinge upon the competitiveness of the licensed and regulated online poker and slots offer and lead to 49% of German players preferring to use unregulated websites, according to a new player survey published by Goldmedia.[1] Players outside of the regulated market would be deprived of the protection of German consumer laws, rendering the proposed tax incompatible with the key objective of the country’s new online gambling regulation due to enter into force on 1 July 2021.[2]

Secondly, the proposed tax measure is punitive and would, in Bavaria for example, result in online poker and slots being taxed at rates 4-5 times higher than their retail equivalent land-based casinos and 15 times higher than slots in land-based amusement arcades. This would provide a substantial and unfair tax advantage to Germany’s land-based operators over their online counterparts. The EGBA believes that this would constitute an illegal state aid under EU law.[3] According to Goldmedia, the substantial tax advantage for land-based operators would be as high as €290 million each year in the state of Bavaria alone.[4]

Example calculation for the state of Bavaria: Total tax advantage for land-based operators of slot machines and casino games compared to the planned taxation on stakes generated by online casino providers

Source: FUTURE DIFFERENCES IN THE BURDEN THROUGH TAXES AND CHARGES ON LAND-BASED AND ONLINE CASINO GAMES AND SLOTS USING THE EXAMPLE OF THE FEDERAL STATE OF BAVARIA, Goldmedia (2021).

In light of these concerns, the EGBA urges members of the German parliament to reconsider the proposed tax measure when it is debated in the Bundestag in the coming weeks. Alternative tax rates, more closely aligned to those imposed by other EU member states,[5] would ensure that the overwhelming majority of German players use licensed websites and benefit from the protection of German consumer laws, in line with the key objective of the country’s new online gambling regulation.

EGBA has already shared its concerns about the proposed tax measure with the European Commission. Should the tax measure be adopted as proposed, EGBA will consider all options, including filing a formal state aid complaint with the European Commission. The European Commission has previously determined that differentiated tax treatment between online and land-based casinos qualifies as a state aid under EU law.[6] In that Danish case, the Commission concluded that a lower tax rate for online casino was justified by the overall consumer protection objectives of creating a regulated and safe online environment, in view of the inevitable competition with the unregulated online market.

In Germany, the Bundesrat actually proposes the opposite: a much higher tax rate on online poker and slots compared to the land-based alternative, without any obvious consumer protection or other valid justification under EU state aid law.[7]

“We welcome the regulation of the German online gambling market, and we fully appreciate that an online gambling tax will need to be paid. However, we urge the German parliament to reconsider the proposed punitive rate of the tax because it will push German players to use unprotected and unregulated black-market websites and give land-based operators a massive tax advantage. We stand ready to share our experiences in other jurisdictions of the EU, and firmly believe that a tax level can be established which strikes the right balance between meeting the needs of the German consumer while ensuring sufficient tax revenue for the state. Should the measure go ahead as proposed, we will have to consider all available options, including filing a state aid complaint with the European Commission.” – Maarten Haijer, Secretary General, EGBA.

– ENDS –

* A German language version of this release is available here.

[1] Use of online casino and online poker in the tolerance and regulation phase, Goldmedia (2021).

[2] The key objective of the 4th German Interstate Treaty on Gambling is to direct online customers from the unregulated into the regulated online gambling market.

[3] Article 107(1) of the Treaty on the Functioning of the European Union.

[4] The proposed 5.3% tax on online poker and slots stakes would equate to a tax rate of ~125% on an online casino operator’s profit or gross gaming revenue (GGR) and would be 4-5 times higher than the 25-30% GGR-based tax the state of Bavaria applies to poker and slots offered in its land-based casinos and 15 times higher than the effective 8% GGR-based VAT tax applied to slots offered in its land-based Bavarian amusement arcades. This would result in a substantial tax advantage for land-based operators in Germany. For the state of Bavaria alone the advantage would be as high as €290 million each year. FUTURE DIFFERENCES IN THE BURDEN THROUGH TAXES AND CHARGES ON LAND-BASED AND ONLINE CASINO GAMES AND SLOTS USING THE EXAMPLE OF THE FEDERAL STATE OF BAVARIA, Goldmedia (2021).

[5] Germany’s proposed tax rate for online poker and slots is 600% higher than the average taxation rate for online casinos in the EU.

[6] Commission Decision of 20 September 2011 on the measure C 35/10 (ex N 302/10) which Denmark is planning to implement in the form of duties for online gambling in the Danish Gaming Duties Act, Official Journal of the European Union.

[7] If the European Commission concluded the tax measure to be an illegal aid, the tax advantage monies will have to be paid back by German land-based operators.

About EGBA

The European Gaming and Betting Association (EGBA) is the Brussels-based trade association representing the leading online gaming and betting operators established, licensed and regulated within the EU, including bet365, Betsson Group, Entain, Kindred Group, and William Hill. The Swedish Trade Association for Online Gambling (BOS) is also an affiliate member. EGBA works together with national and EU regulatory authorities and other stakeholders towards a well-regulated and well-channeled online gambling market which provides a high level of consumer protection and takes into account the realities of the internet and online consumer demand. EGBA member companies meet the highest regulatory standards and have 145 online gambling licenses to provide their services to 16 million customers in 17 different European countries.