EU Market

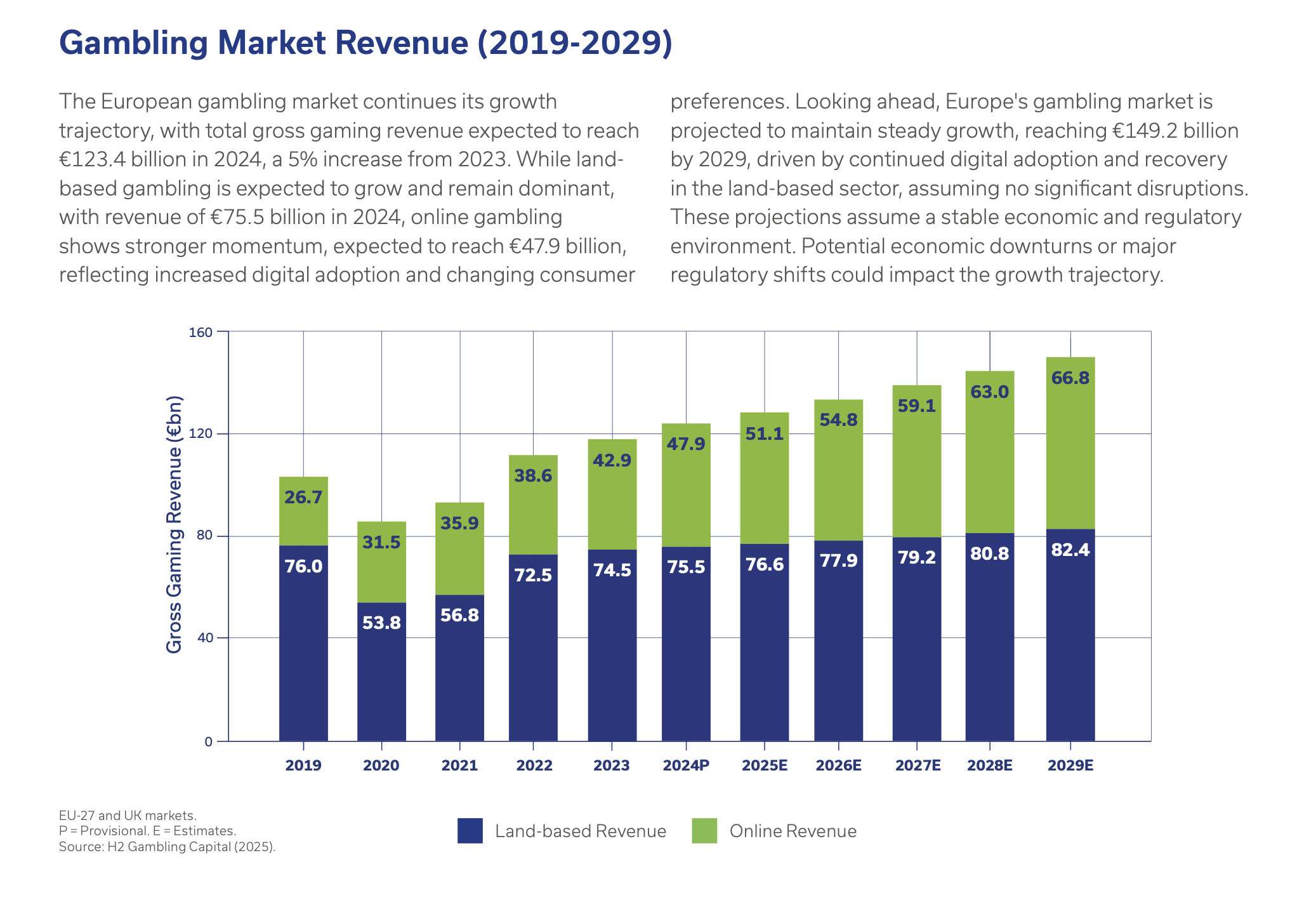

Gambling Market Revenue (2019-2029)

The European gambling market continues its growth trajectory, with total gross gaming revenue expected to reach €123.4 billion in 2024, a 5% increase from 2023. While land- based gambling is expected to grow and remain dominant, with revenue of €75.5 billion in 2024, online gambling shows stronger momentum, expected to reach €47.9 billion, reflecting increased digital adoption and changing consumer preferences. Looking ahead, Europe’s gambling market is projected to maintain steady growth, reaching €149.2 billion by 2029, driven by continued digital adoption and recovery in the land-based sector, assuming no significant disruptions. These projections assume a stable economic and regulatory environment. Potential economic downturns or major regulatory shifts could impact the growth trajectory.

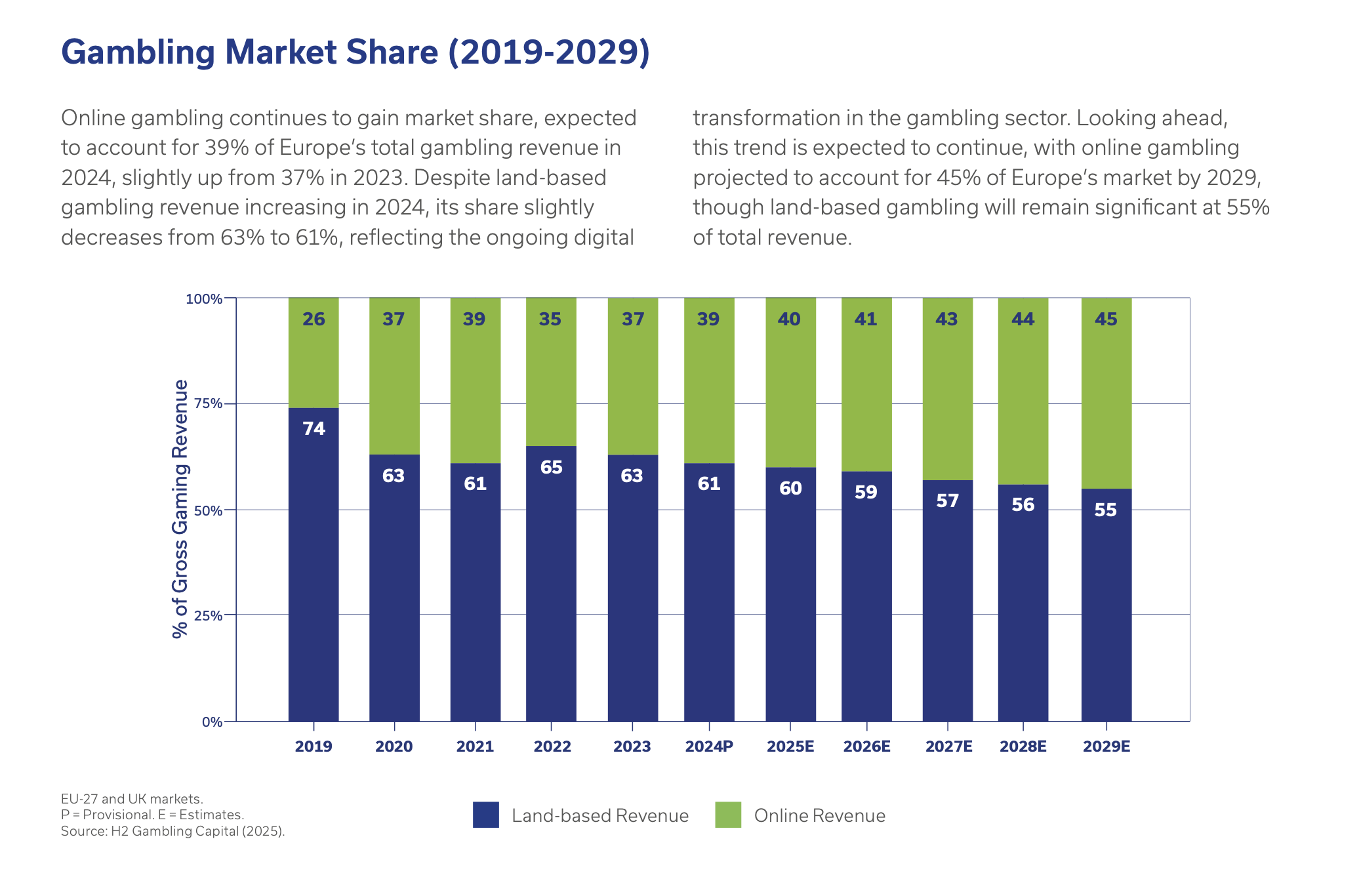

Gambling Market Share (2019-2029)

Online gambling continues to gain market share, expected to account for 39% of Europe’s total gambling revenue in 2024, slightly up from 37% in 2023. Despite land-based gambling revenue increasing in 2024, its share slightly decreases from 63% to 61%, reflecting the ongoing digital transformation in the gambling sector. Looking ahead, this trend is expected to continue, with online gambling projected to account for 45% of Europe’s market by 2029, though land-based gambling will remain significant at 55% of total revenue.

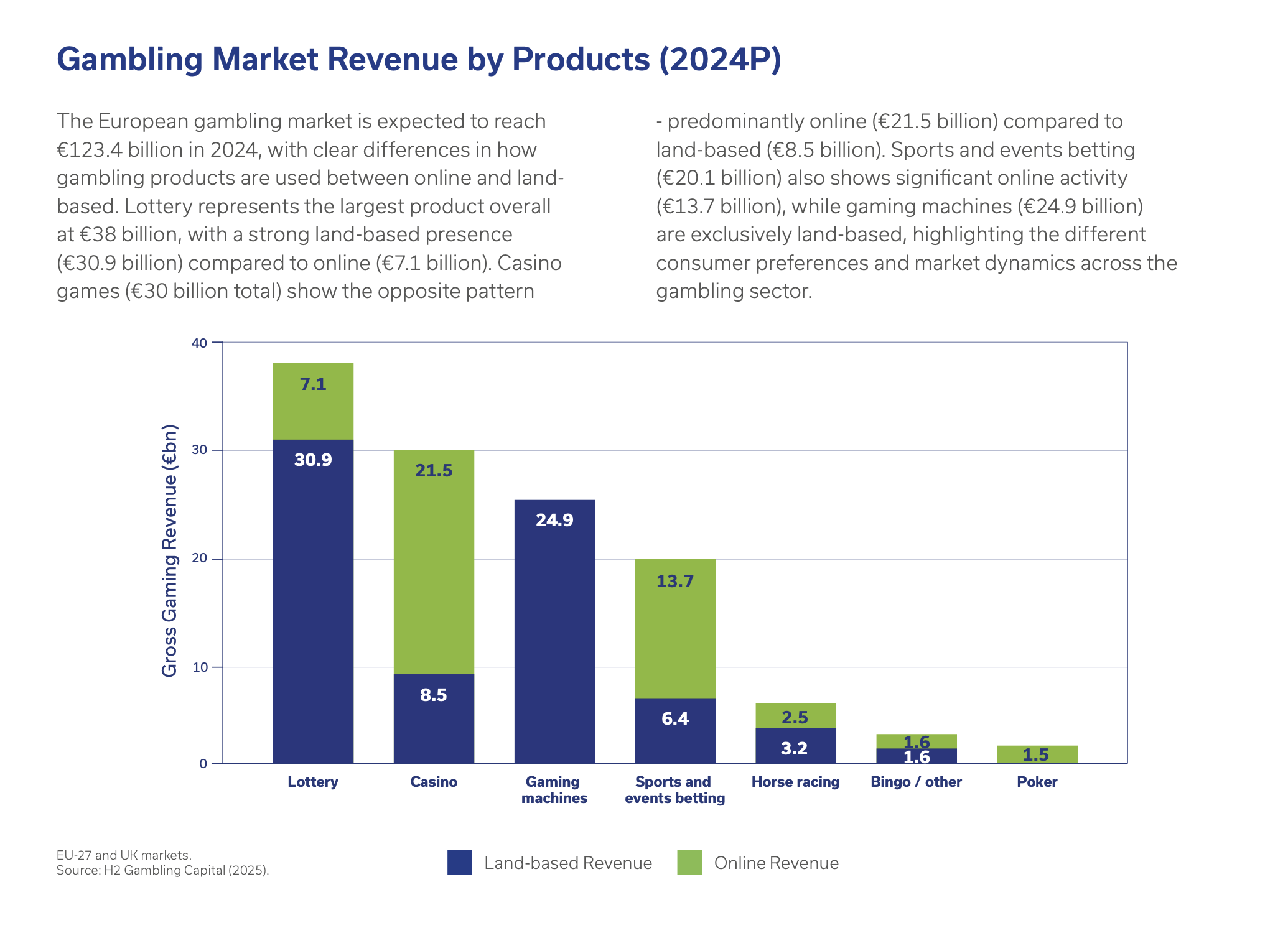

Gambling Market Revenue By Products (2024P)

The European gambling market is expected to reach €123.4 billion in 2024, with clear differences in how gambling products are used between online and land- based. Lottery represents the largest product overall at €38 billion, with a strong land-based presence (€30.9 billion) compared to online (€7.1 billion). Casino games (€30 billion total) show the opposite pattern – predominantly online (€21.5 billion) compared to land-based (€8.5 billion). Sports and events betting (€20.1 billion) also shows significant online activity (€13.7 billion), while gaming machines (€24.9 billion) are exclusively land-based, highlighting the different consumer preferences and market dynamics across the gambling sector.

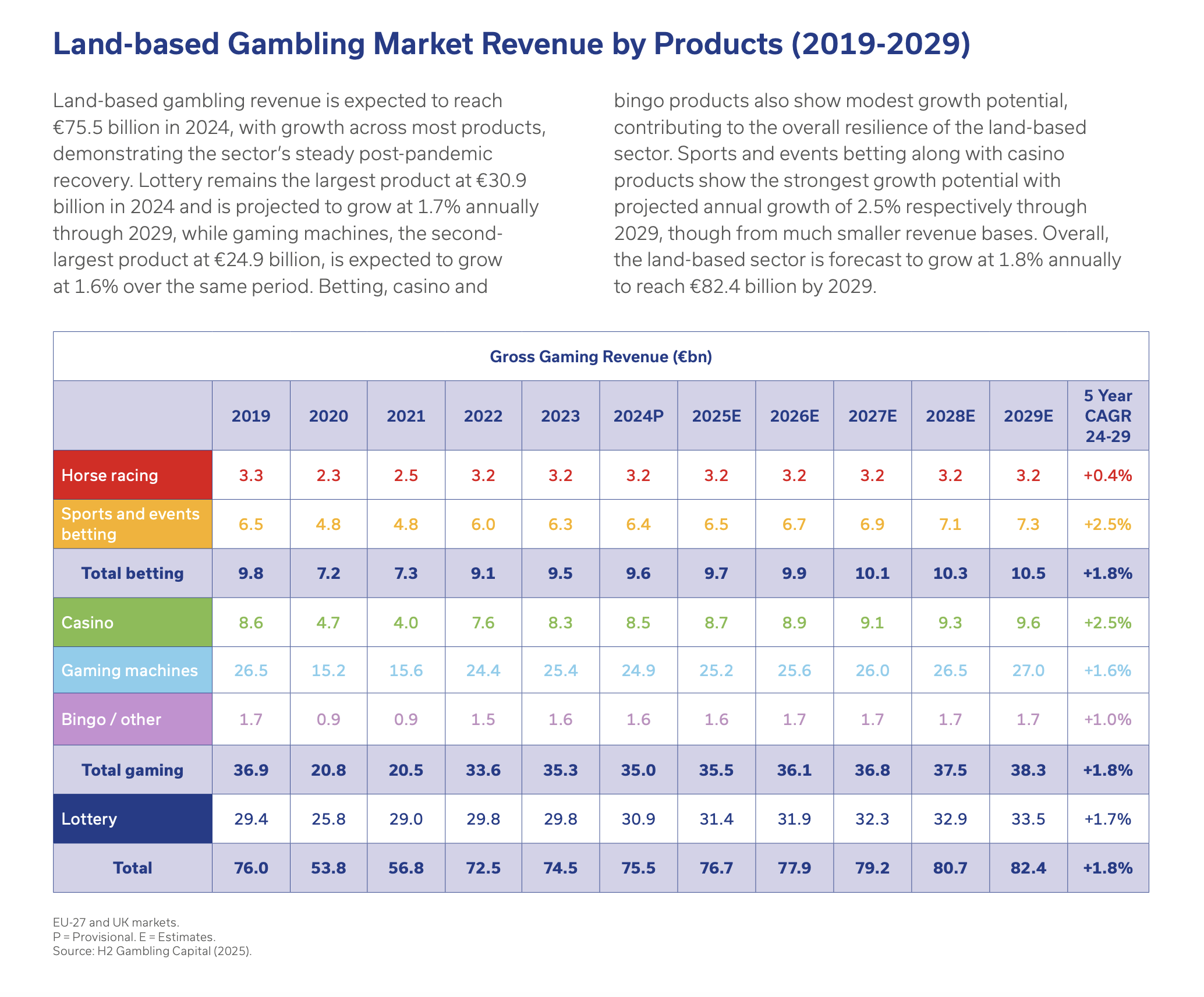

Land-Based Gambling Market Revenue By Products (2019-2029)

Land-based gambling revenue is expected to reach €75.5 billion in 2024, with growth across most products, demonstrating the sector’s steady post-pandemic recovery. Lottery remains the largest product at €30.9 billion in 2024 and is projected to grow at 1.7% annually through 2029, while gaming machines, the second- largest product at €24.9 billion, is expected to grow at 1.6% over the same period. Betting, casino and bingo products also show modest growth potential, contributing to the overall resilience of the land-based sector. Sports and events betting along with casino products show the strongest growth potential with projected annual growth of 2.5% respectively through 2029, though from much smaller revenue bases. Overall, the land-based sector is forecast to grow at 1.8% annually to reach €82.4 billion by 2029.

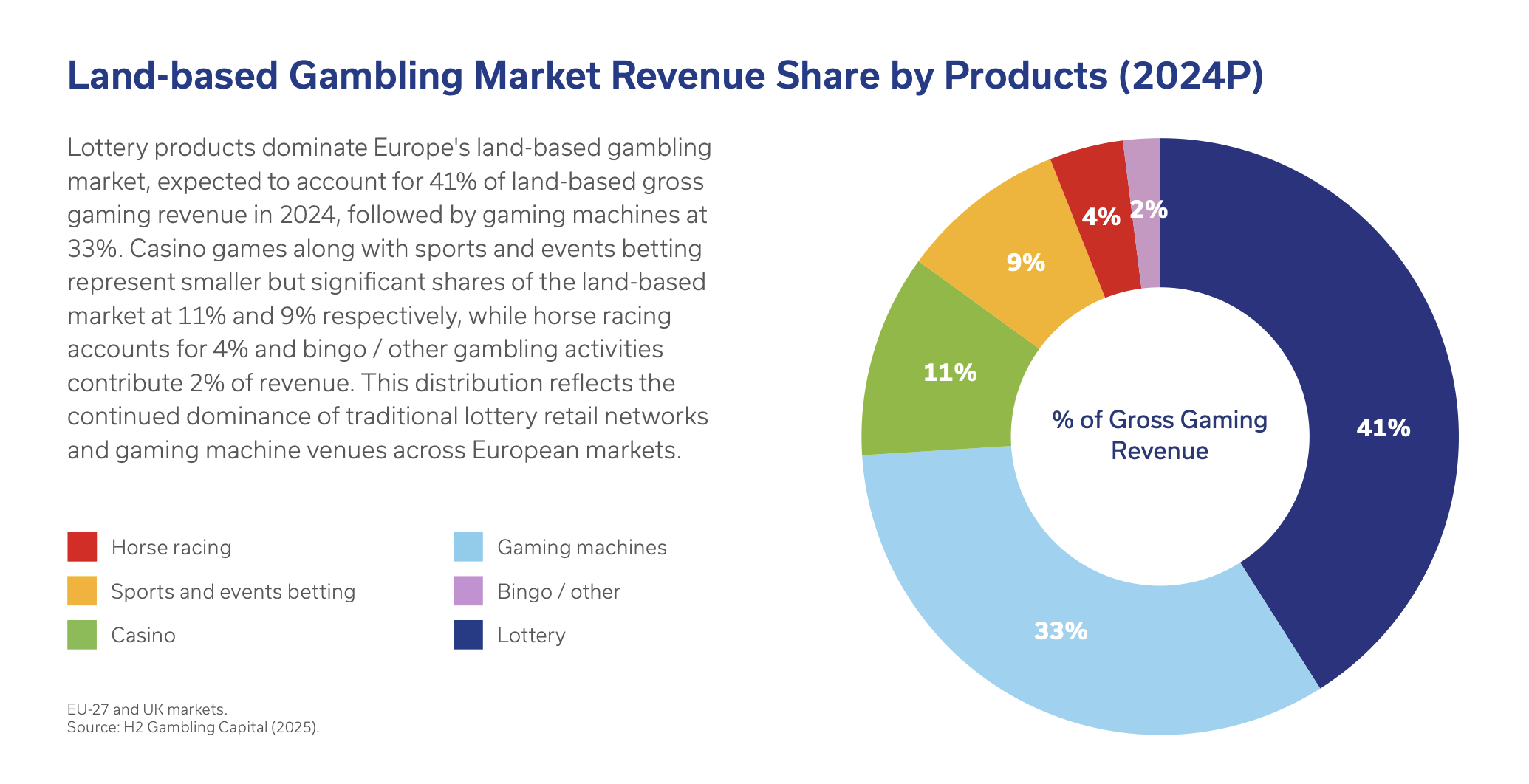

Land-Based Gambling Market Revenue Share By Products (2024P)

Lottery products dominate Europe’s land-based gambling market, expected to account for 41% of land-based gross gaming revenue in 2024, followed by gaming machines at 33%. Casino games along with sports and events betting represent smaller but significant shares of the land-based market at 11% and 9% respectively, while horse racing accounts for 4% and bingo / other gambling activities contribute 2% of revenue. This distribution reflects the continued dominance of traditional lottery retail networks and gaming machine venues across European markets.

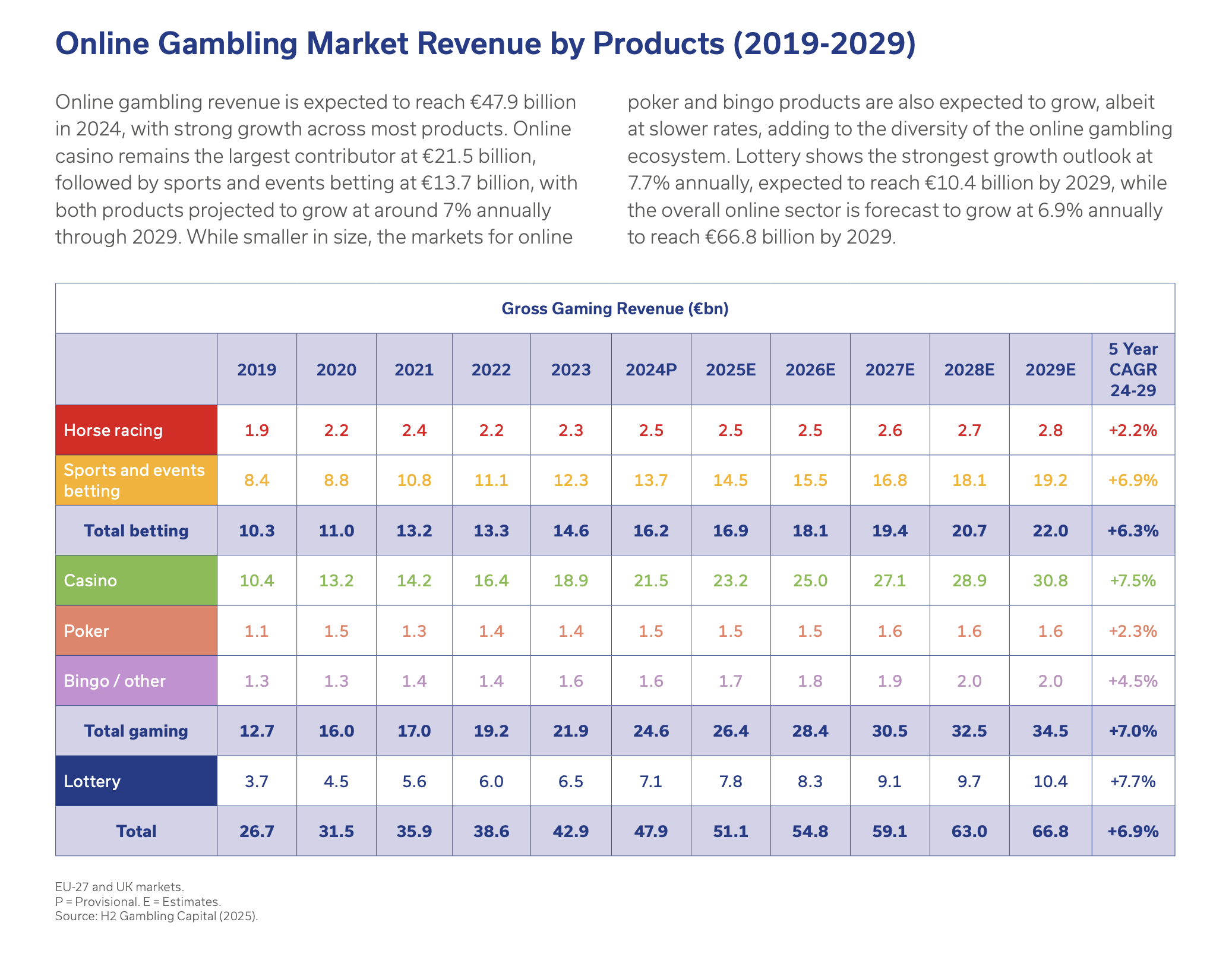

Online Gambling Market Revenue By Products (2019-2029)

Online gambling revenue is expected to reach €47.9 billion in 2024, with strong growth across most products. Online casino remains the largest contributor at €21.5 billion, followed by sports and events betting at €13.7 billion, with both products projected to grow at around 7% annually through 2029. While smaller in size, the markets for online poker and bingo products are also expected to grow, albeit at slower rates, adding to the diversity of the online gambling ecosystem. Lottery shows the strongest growth outlook at 7.7% annually, expected to reach €10.4 billion by 2029, while the overall online sector is forecast to grow at 6.9% annually to reach €66.8 billion by 2029.

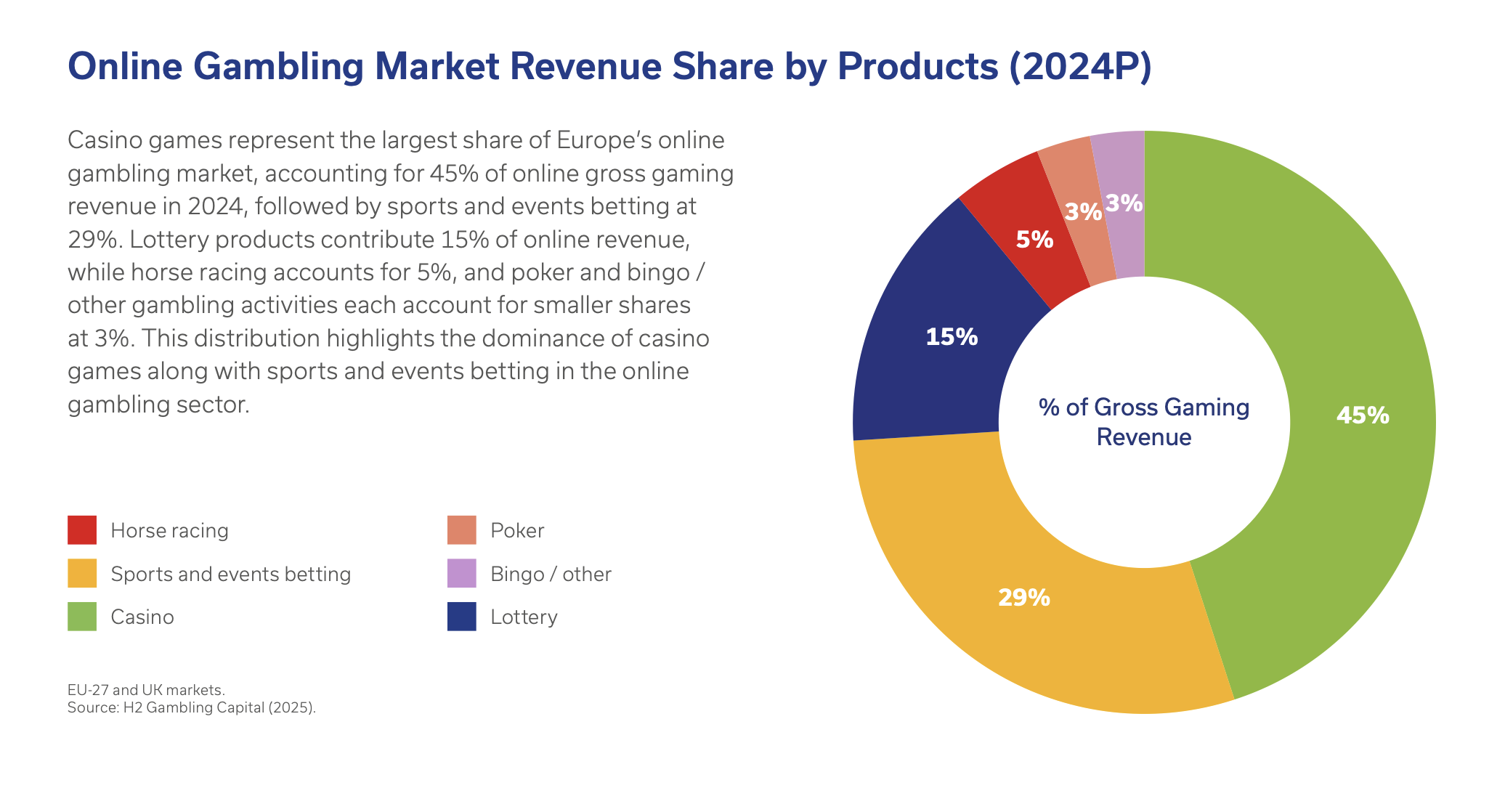

Online Gambling Market Revenue Share By Products (2024P)

Casino games represent the largest share of Europe’s online gambling market, accounting for 45% of online gross gaming revenue in 2024, followed by sports and events betting at 29%. Lottery products contribute 15% of online revenue, while horse racing accounts for 5%, and poker and bingo / other gambling activities each account for smaller shares at 3%. This distribution highlights the dominance of casino games along with sports and events betting in the online gambling sector.

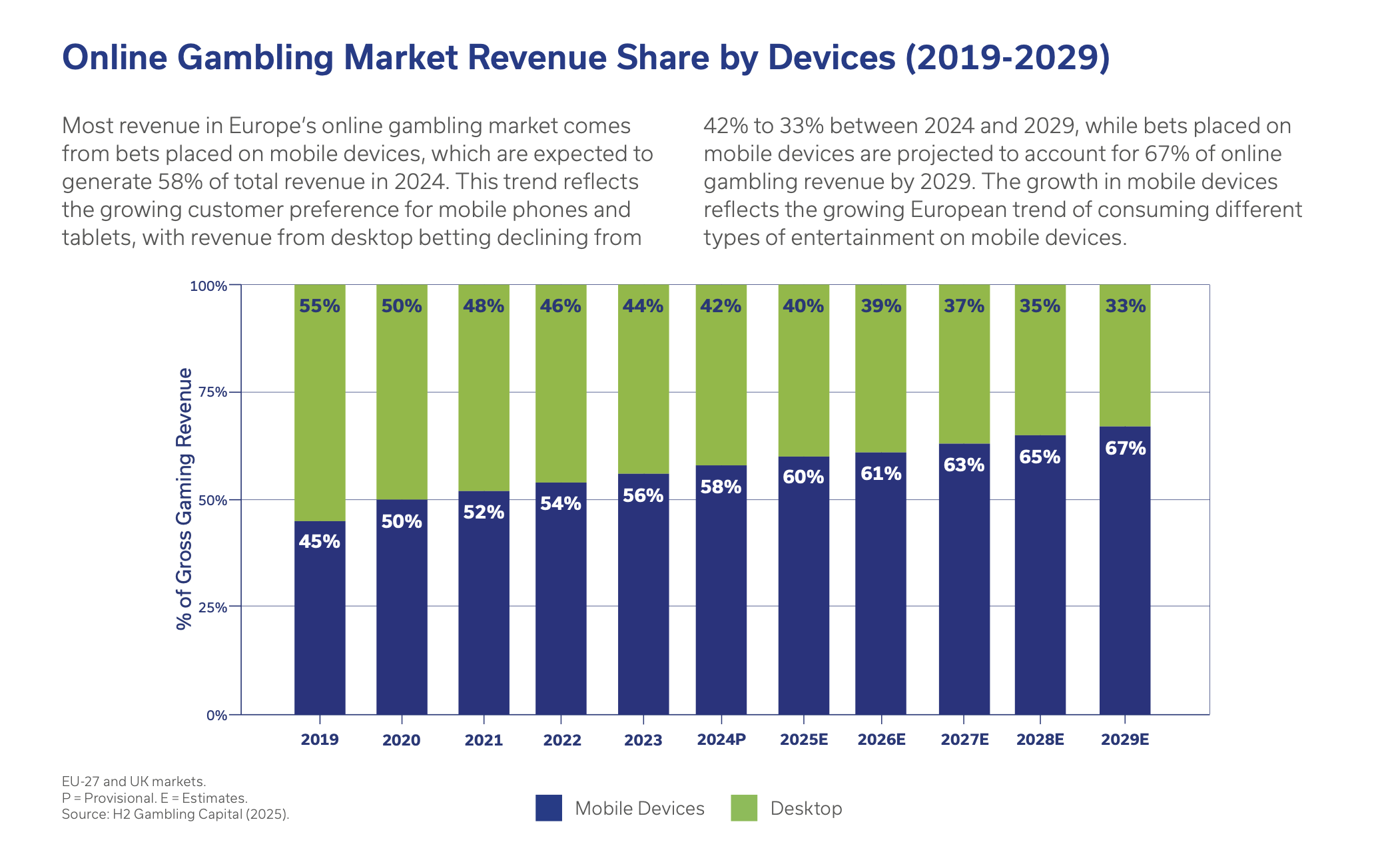

Online Gambling Market Revenue Share By Devices (2019-2029)

Most revenue in Europe’s online gambling market comes from bets placed on mobile devices, which are expected to generate 58% of total revenue in 2024. This trend reflects the growing customer preference for mobile phones and tablets, with revenue from desktop betting declining from 42% to 33% between 2024 and 2029, while bets placed on mobile devices are projected to account for 67% of online gambling revenue by 2029. The growth in mobile devices reflects the growing European trend of consuming different types of entertainment on mobile devices.

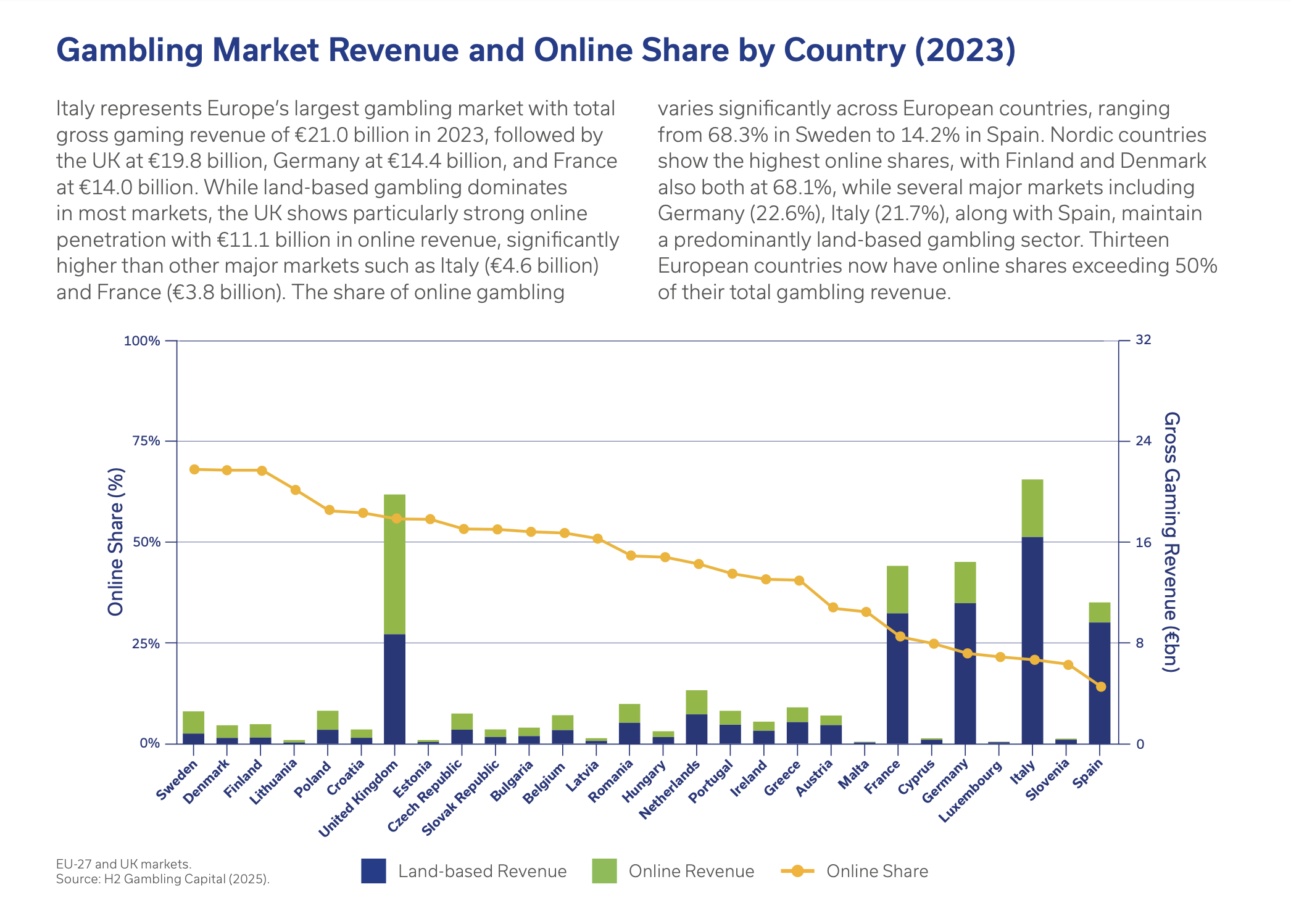

Gambling Market Revenue And Online Share By Country (2023)

Italy represents Europe’s largest gambling market with total gross gaming revenue of €21.0 billion in 2023, followed by the UK at €19.8 billion, Germany at €14.4 billion, and France at €14.0 billion. While land-based gambling dominates in most markets, the UK shows particularly strong online penetration with €11.1 billion in online revenue, significantly higher than other major markets such as Italy (€4.6 billion) and France (€3.8 billion). The share of online gambling varies significantly across European countries, ranging from 68.3% in Sweden to 14.2% in Spain. Nordic countries show the highest online shares, with Finland and Denmark also both at 68.1%, while several major markets including Germany (22.6%), Italy (21.7%), along with Spain, maintain a predominantly land-based gambling sector. Thirteen European countries now have online shares exceeding 50% of their total gambling revenue.

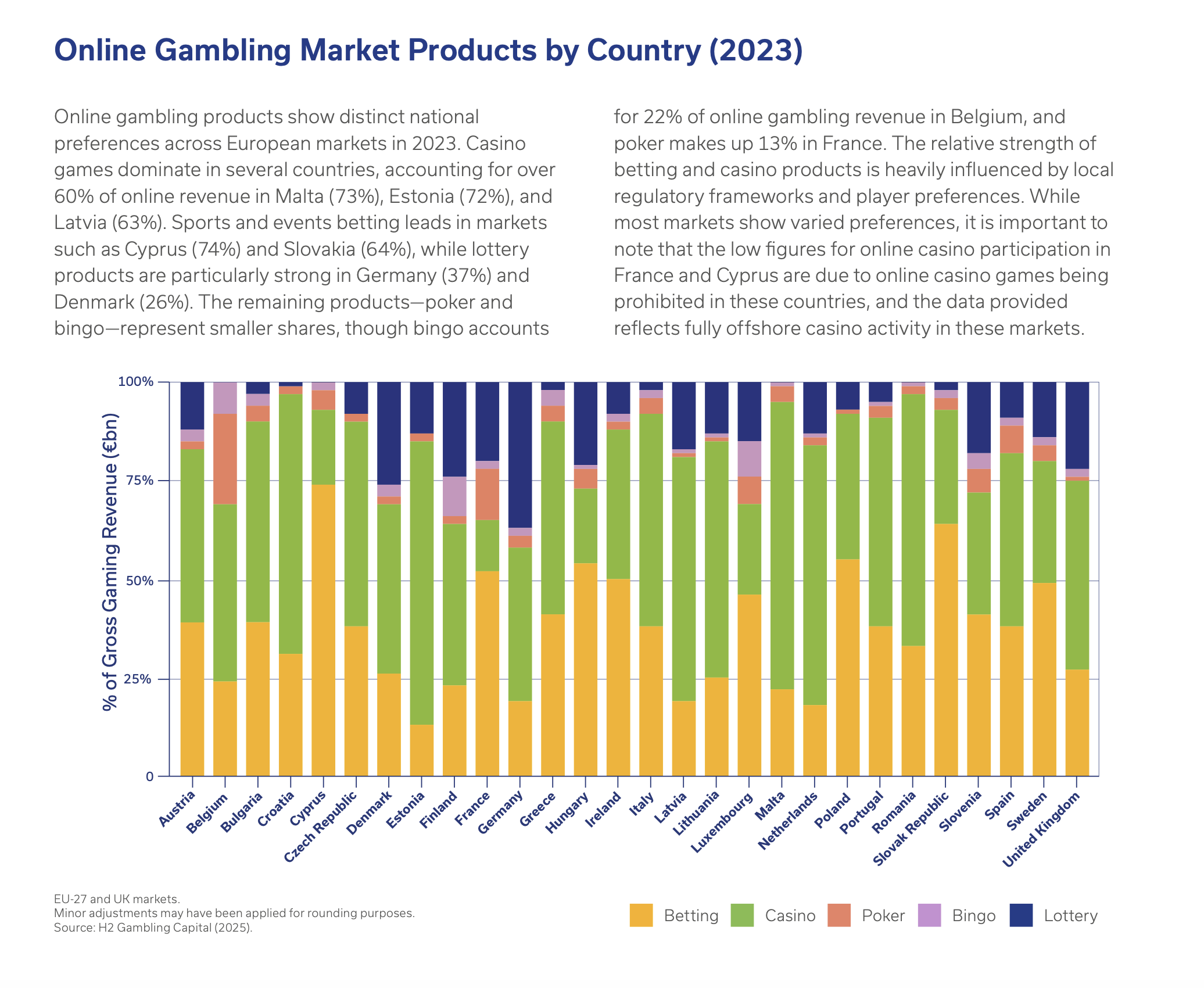

Online Gambling Market Products By Country (2023)

Online gambling products show distinct national preferences across European markets in 2023. Casino games dominate in several countries, accounting for over 60% of online revenue in Malta (73%), Estonia (72%), and Latvia (63%). Sports and events betting leads in markets such as Cyprus (74%) and Slovakia (64%), while lottery products are particularly strong in Germany (37%) and Denmark (26%). The remaining products—poker and bingo—represent smaller shares, though bingo accounts for 22% of online gambling revenue in Belgium, and poker makes up 13% in France. The relative strength of betting and casino products is heavily influenced by local regulatory frameworks and player preferences. While most markets show varied preferences, it is important to note that the low figures for online casino participation in France and Cyprus are due to online casino games being prohibited in these countries, and the data provided reflects fully offshore casino activity in these markets.